Guide

Term life insurance explained

What is term life insurance?

Term life insurance is a type of insurance policy that covers you for a fixed period or ‘term’ of years.

For example, if you take out a fixed-term life insurance policy that covers you for 50 years and you die within that time frame, then your beneficiaries will receive a cash lump sum. But, if you die outside the agreed period, then your beneficiaries would not receive anything.

How does term life insurance work?

Term life insurance works the same way as most life insurance policies. You pay a monthly premium in return for life cover.

Unlike whole of life insurance, term life insurance has a fixed end date. As a result, you will need to decide how long you want your life insurance policy to last.

Term life insurance policies generally last between five and 50 years.

What's the difference between term life and whole life insurance?

Term life insurance - is more affordable as the insurer covers you for a certain period of time.

Unlike whole of life insurance, term life insurance has a fixed end date. As a result, you will need to decide how long you want your life insurance policy to last. On the whole, term life insurance policies last between five and 50 years.

It’s important to be aware that if you are still alive when the policy expires, your beneficiaries will not receive a pay out. You will also not get refunded for the premiums you paid.

Whole of life insurance - guarantees a payout on death. It's usually more expensive because you’re covered for your entire life.

Find out more about whole of life insurance policies and how they work, our guide contains everything you need.

The cost of term life insurance

We’ve discussed how term life insurance is cheaper than whole of life insurance, and how certain types of term insurance are cheaper than others. But, it’s also helpful to be aware of other factors that can affect the cost of term life insurance.

As well as the type of life insurance you choose, the cost of term life insurance can be influenced by:

- Your age

- Your health

- Your family medical history

- Your occupation

- Your hobbies

- Your lifestyle style

Which type of term insurance is right for me?

Think about why you're taking out a term life insurance policy. The type and duration of your policy will depend on your personal situation. To get a better idea on which is the best type of term insurance for your situation, have a think about the following:

What would you like the term insurance to cover?

You may be looking to provide your family with enough to pay off your mortgage. Do you need to cover other expenses such as:

- education fees

- childcare costs

- debts

- general living costs

The age of your dependents

This can affect how long you want to cover for, too. For example, if your children are very young - you might want to be covered for longer as they'll be financially dependent for longer.

Your own life expectancy

No one can predict the future, but you might want to consider how long you will need life insurance. For example, if you’re a healthy 30 year-old, taking out fixed-term life insurance policy for 5 years may not be very useful. So, try to be realistic about how long you might need life cover. You could take out another plan once your policy expires. But remember, life insurance is more expensive the older you are.

The different types of term life insurance

There are three different types of term life insurance. Each type suits different individual needs and circumstances. For instance, do you have dependants that you want to protect? Do you have debt that would need paying off if you passed away? Answering these questions will help you pick the right type of term life insurance.

Decreasing term insurance

This is typically used to protect mortgage repayments and is often taken out at the same as a mortgage. The amount you're covered for decreases in line with your remaining mortgage amount. What you pay stays exactly the same for the policy duration.

The cash lump sum reduces over the fixed term.

People choose this option when they want protection for a repayment mortgage. They choose a decreasing term because their mortgage repayments reduce over the mortgage period.

Decreasing term insurance is cheaper than level term insurance (below). This is because the amount of cover reduces every year.

Decreasing term insurance is ideal if you want to leave your loved ones with enough to pay off your mortgage. But, if you want to leave them with some extra to cover childcare, educational or general living costs, then you might want to consider another kind of term insurance.

Level term insurance

Both your premiums and your cover remain the same throughout the policy term. So you know exactly what you’re getting with Level term insurance.

People also choose level term insurance when they want a guaranteed lump sum. This can cover childcare costs or other general living costs.

The conditions of level-term insurance remain the same throughout the policy. This might be appealing to you.

But, level-term life insurance policies do not account for inflation. This means that over time the amount you’re insured for may not be worth as much at the end of the policy as it was at the start.

Think about if you should take out a little more cover than you think you need or look at increasing life insurance.

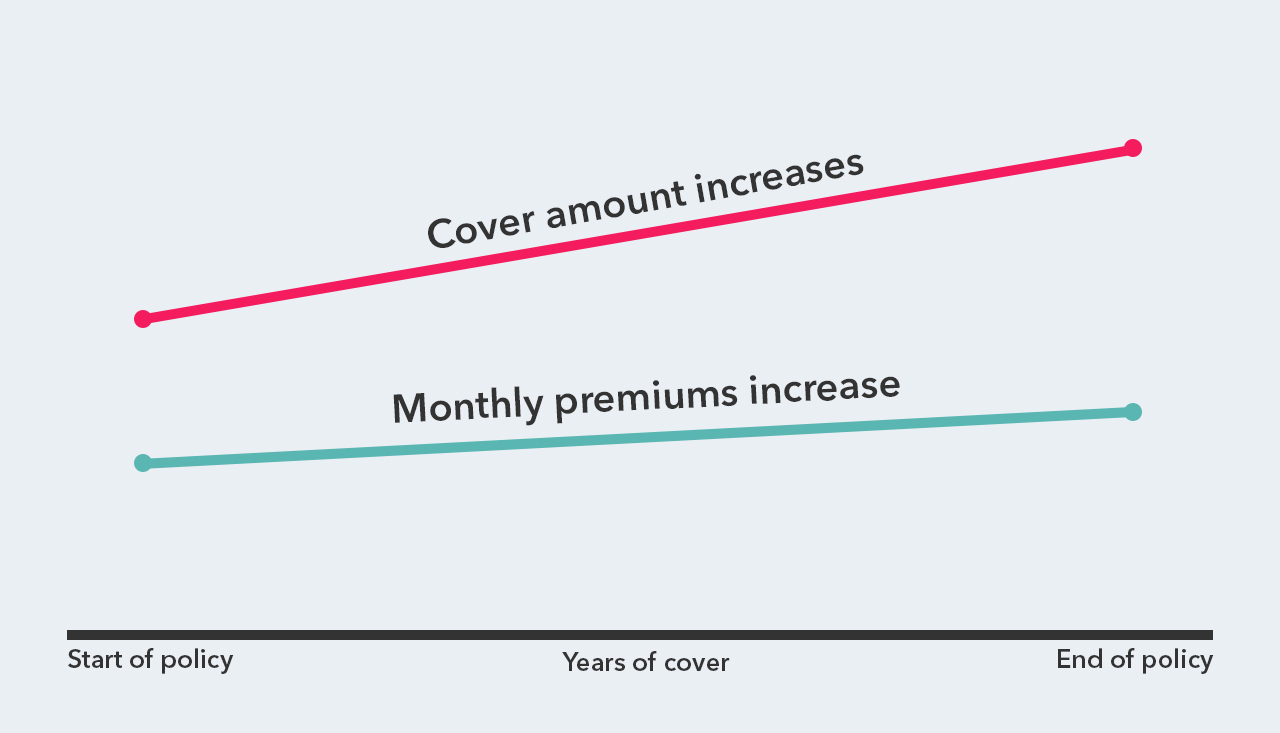

Increasing term insurance

The cash lump sum increases over the fixed term.

With increasing term life insurance the monthly premium and the cover increase over time. It’s ideal if you want your pay out to cover the future cost of goods and are worried about inflation.

Increasing term insurance helps you to feel confident that your policy will roughly keep track with the rising cost of living.

Increasing term insurance is more expensive than level and decreasing term insurance. But, the advantage is the pay out will often stretch further than the other types of level term insurance.

People choose this option when they want their payout to cover the future cost of goods. The cost of goods increase with inflation in the economy.

They choose an increasing term because they want their cash lump sum to be worth the same in the future.

Get additional cover

In addition to life insurance, there are also other types of cover for illness and injury:

-

Serious illness cover

Covers you against serious illnesses. It gives you a cash lump sum while you recover, but does not pay out if you die.

-

Income protection insurance

Covers you if you fall ill or get injured and can’t work. It gives you a monthly payment to help cover your life expenses.

How are premiums calculated?

Premiums for term life insurance are calculated on age and general health. The older you are, the more expensive your premiums will be. This is because the chances of you falling ill or dying increase with age. Premiums will also be more expensive if you smoke.

If you become terminally ill or die during the policy term, your beneficiaries can make a claim. They would need to contact your life insurance provider.

How to make a claim

To make a claim, they would need the following documents:

- Claimant’s name

- Claim details, e.g. cause of death

- Claimant’s GP or consultant details.

Your insurer may also need further information. For example proof of ID, bank details and a death certificate.

Does term life insurance have a cash value?

No, term life insurance does not have a cash value.

The beneficiary (often the family) would only receive a payout if you died within the covered fixed term.

If you want a guaranteed payout, you should consider a whole of life insurance plan.

What happens when term life insurance expires?

If you don’t get diagnosed with a terminal illness or do not die within the fixed term, you do not receive a payout.

Contact your life insurer or financial adviser to see what options they provide.

Is term life insurance taxable?

In most scenarios, term life insurance is not subject to tax.

But, there are some scenarios where the beneficiary may become liable for tax:

- On any interest gained on the lump sum between the death of the plan holder and the payout

- If the payment is part of the deceased’s estate, inheritance tax would need to be paid above the Inheritance Tax threshold (also known as IHT threshold).

Read the Government’s help sheet on Gains on UK life insurance policies for all the latest tax advice.

Find out more about our term life insurance.

Why choose Vitality's term life insurance?

✓ A brand you can trust – 99.7% of life cover claims paid (Vitality Claims and Benefits Report, 2024)

✓ Discounts and rewards – access a range of discounts and rewards to help you lead a healthy lifestyle

✓ Get up to 40% off your first year’s premiums with Optimiser.

Relevant guides and articles

-

Whole of life insurance

Unlike term life insurance, whole of life insurance covers you for your lifetime. Learn more about whole of life insurance in our guide.

-

Mortgage protection insurance

Mortgage protection is a type of term life insurance designed to pay off your mortgage. Read our guide to help decide if it's a good option for you and your family.

-

Serious and critical illness cover

Serious and critical illness cover pays out a lump sum to you if you’re diagnosed with a serious illness. It’s common to add on this option to a life insurance plan. Learn more about how it works, what illnesses it covers, and more in our guide